Introduction

Are you wondering where to start with developing your credit card marketing strategy?

Great news: you’re in the right place.

With the number of credit cards in the U.S. reaching an all-time high of 543.1 million in Q1 of 2024, the market for credit card products is more vibrant and competitive than ever. This comprehensive guide will help you navigate the evolving landscape of credit card marketing, from understanding your audience to implementing effective acquisition and retention strategies.

Explore this guide to learn:

- How to create an effective credit card marketing strategy

- Key tactics for customer acquisition

- How to design a card that customers want to carry in their wallets

- How to get customers to activate and start using their cards effectively

- The essential metrics to track and measure the success of your credit card marketing programs

What is credit card marketing?

Credit card marketing refers to the strategic promotion and positioning of credit card products to both potential and existing customers. Credit cards are unique among financial products because they are often the one item customers carry with them daily, giving banks and credit unions a continual touchpoint to build engagement and loyalty. This constant presence provides a significant opportunity for financial institutions to highlight their card’s value and reinforce their brand.

At its core, credit card marketing involves more than just acquiring new customers; it’s about nurturing long-term relationships, enhancing engagement, and fostering loyalty through targeted promotions, personalized offers, and consistent value delivery. It requires a deep understanding of customer behavior, market trends, and regulatory requirements to craft compelling messaging that connects with various audience segments.

Key objectives of credit card marketing

- Customer Acquisition: Attracting new customers through a variety of tactics such as digital advertising, direct mail, partnerships, and exclusive promotions. Successful acquisition strategies focus on identifying the right customer segments and delivering tailored offers that meet their specific needs.

- Customer Activation: Activation focuses on encouraging new customers to start using their cards immediately after acquisition. Effective activation strategies include welcome bonuses, initial spending rewards, and clear communications that motivate first-time use, establishing early habits that drive ongoing card usage.

- Customer Retention: Retaining existing customers is crucial for sustained growth. Retention efforts often include personalized communications, robust loyalty programs, and special offers designed to encourage ongoing card use and minimize attrition.

- Customer Engagement: Beyond acquisition and retention, building deeper customer relationships is essential. Engagement tactics might include educational content, interactive social media campaigns, and initiatives that promote repeat card use and positive customer experiences.

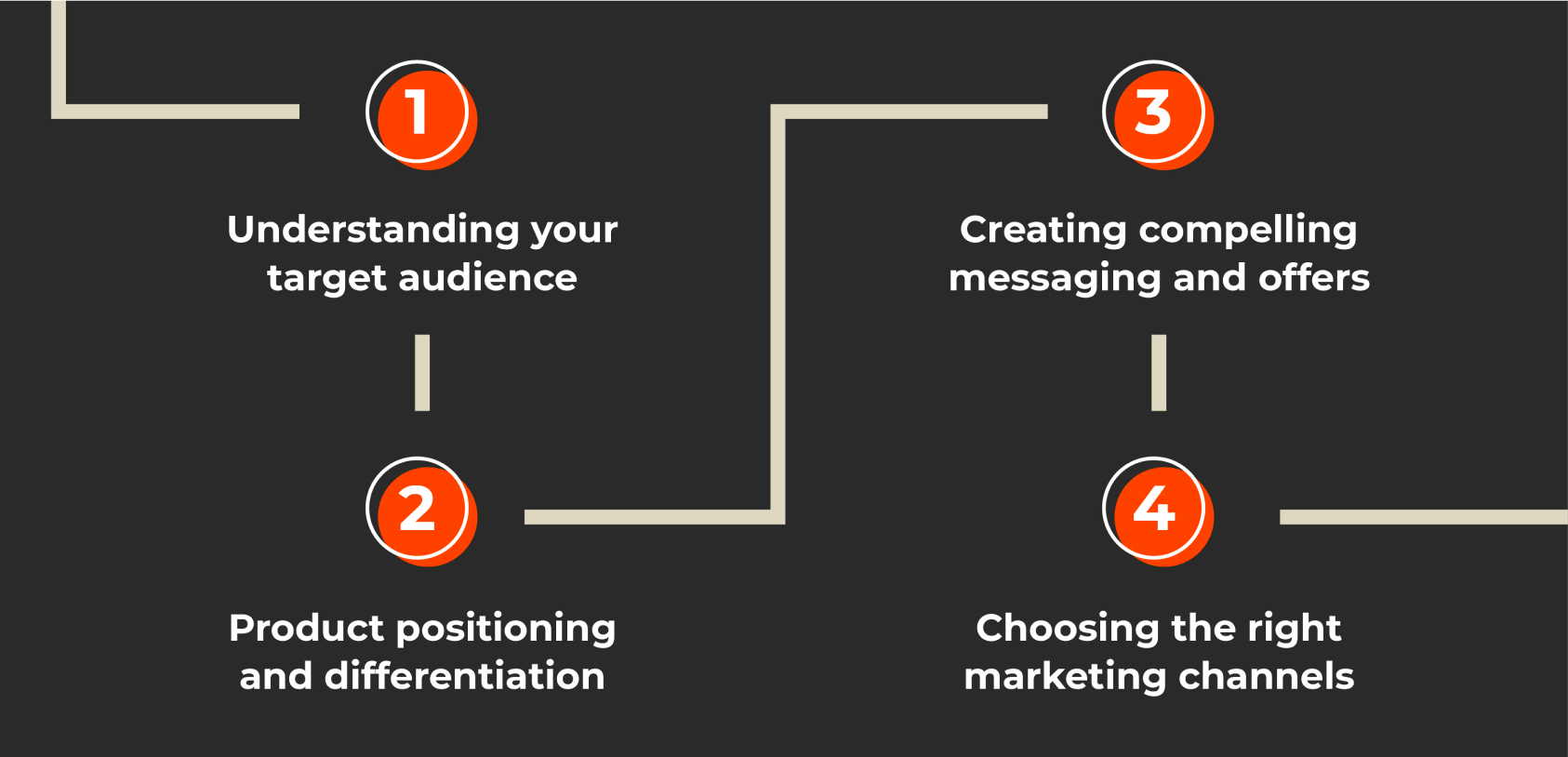

Key elements of a successful credit card marketing strategy

A successful credit card marketing strategy requires a deep understanding of your audience, effective differentiation of your product, compelling messaging, and a multichannel approach that reaches your target customers where they are most likely to engage. Below are the key elements to consider:

1. Understanding your target audience

To build a winning credit card marketing strategy, it’s essential to understand how to effectively segment credit card customers by using data analytics, market research, and customer surveys. Segmenting your customers based on demographics, spending behaviors, and preferences allows you to tailor your marketing campaigns and product offerings more precisely to each group.

Customer segmentation

Identify different consumer profiles, such as “travel enthusiasts,” “cashback seekers,” or “students building credit,” to design credit card offers that meet their unique needs.

Persona development

To maximize the effectiveness of your credit card marketing, develop a single, detailed persona for each of your card products. This persona should represent your ideal customer for that specific card, complete with a name like “Ethan” or “Megan” to humanize the marketing process. This approach allows your team to design all marketing and communications as if they are speaking directly to that person, ensuring consistency and relevance. For example, your team should ask, “Would Ethan find this offer appealing?” or “How would Megan react to this promotion?”

Creating a distinct persona helps align all aspects of your strategy, from messaging to channel selection, and enables your team to maintain a focused and personalized approach.

Learn how to elevate your credit card marketing with personas

Read the Blog2. Product positioning and differentiation

In a crowded market, understanding strategies for positioning credit cards in a competitive market is crucial. Differentiation can be achieved through unique features, such as cashback rewards, travel benefits, zero foreign transaction fees, or competitive interest rates. Your Unique Selling Proposition (USP) should make your credit card the preferred choice for your target customers.

Unique selling proposition (USP)

Clearly define not only what sets your credit card apart from competitors — such as offering the best travel perks or the lowest APR — but also what specific need(s) you are addressing for your

target persona.

Remember, differentiation doesn’t always require complete uniqueness. If you have a loyal customer base, focus on your point of view (POV) regarding the value you provide based on your target persona’s needs. For example, if your persona is a frequent traveler like “Megan,” emphasize how your card offers rewards that align with Megan’s travel habits and preferences, even if similar features exist elsewhere.

Competitive analysis

Conducting a regular review of your competitors’ offerings is a critical step to helping you differentiate your card. This analysis should be refreshed on an annual basis, and should be paired with an analysis on your own product’s performance.

3. Creating compelling messaging and offers

Develop promotional offers that resonate with the specific needs and pain points of your target segments. For example, offering a high welcome bonus or 0% introductory APR could be ideal for customers seeking immediate value.

- Promotional offers

Design offers that appeal to different segments (e.g., cashback for everyday spending, reward points for travel, or low introductory APR for balance transfers). - Content strategy

Craft a content strategy that addresses your audience’s pain points, aspirations, and interests.

4. Choosing the right marketing channels

A strong credit card marketing strategy involves using multichannel marketing strategies for credit card campaigns to reach your target audience effectively. Different channels may resonate with different customer segments, so it’s crucial to choose those where your target audience is most active.

- Direct marketing channels

Implement direct mail and email to directly engage with your customers. - Digital marketing channels

Leverage SEO, content marketing, PPC advertising, and social media to connect with digital-savvy customers. - Traditional marketing channels

Utilize TV and radio to reach specific demographics or local markets. - Partnerships

Consider co-branded credit cards and affiliate marketing partnerships to expand your reach and drive acquisitions.

To truly understand how these elements come together in a successful campaign, it’s helpful to see them in action.

The launch of the PayPal Cash Mastercard® is representative of how to effectively integrate available marketing channels and appropriate messaging to create a campaign that not only captured attention but also drove meaningful engagement and results.

Credit card acquisition strategies

Acquiring new customers is the lifeblood of any successful credit card marketing strategy. To do this effectively, it’s essential to leverage a combination of digital marketing tactics, traditional marketing methods, and partnership opportunities. Each approach allows you to reach different customer segments and attract them to your card offerings in ways that resonate with their unique preferences and behaviors.

Digital marketing tactics

Digital marketing is a vital tool for credit card acquisition, enabling you to connect with potential customers where they spend much of their time: online. Effective digital strategies use a mix of SEO, content marketing, PPC advertising, and social media to engage prospective cardholders

Traditional marketing tactics

Despite the rise of digital channels, traditional marketing methods remain powerful tools for reaching specific customer demographics and leveraging in-person interactions. By combining in-branch activations, call center opportunities, and direct mail campaigns, you can create a robust, multichannel strategy that effectively drives credit card acquisition.

In-branch activation

Even in the digital age, in-branch activations are a highly effective method for engaging customers. When customers visit a branch, bank employees can identify their needs and recommend relevant credit card products. This direct, face-to-face interaction allows for a personalized sales experience, increasing the likelihood of customer acceptance. The key here is to ensure the branch associates have the training and resources to help them make appropriate recommendations.

Call centers

Call centers are often overlooked in credit card acquisition strategies, yet they provide a valuable opportunity to engage with customers in real-time. By training customer service representatives to recognize potential needs, they can proactively offer relevant credit card products. For example, if a customer mentions an upcoming move, it might be the perfect time to offer a low-rate or promotional 0% APR credit card to help manage upcoming expenses. This approach not only enhances the quality of service but also helps address customer needs more comprehensively.

Direct mail campaigns

Despite the rise of digital channels, direct mail remains a valuable tool due to its higher response rates and ability to create a memorable, tangible connection with customers. It cuts through digital clutter, with an average lifespan much longer than digital tactics.

Why direct mail still matters in credit card marketing

READ THE BLOGAffiliate and influencer marketing

Leverage strategic partnerships, affiliate networks, and influencer collaborations to expand your reach.

Affiliate marketing programs

Collaborate with personal finance bloggers, comparison websites, and other affiliates who can promote your credit cards to their audiences. Offer attractive commissions or incentives for each approved application or new customer referred by an affiliate and provide them with compelling marketing materials to drive conversions.

Influencer collaborations

Work with influencers in relevant niches, such as personal finance, travel, or lifestyle, to create authentic content that demonstrates the benefits of your credit card. Influencers can share their personal experiences with your card, highlighting unique features and perks in a way that engages with

their followers.

Bringing it all together: integrated campaigns

An effective credit card acquisition strategy uses a blend of digital and traditional channels to create a seamless experience for potential customers. By integrating these elements, you ensure consistent messaging across all touchpoints and maximize each channel’s unique strengths. For example, a campaign might begin with an influencer promoting a card on social media, followed by a targeted direct mail piece, and then a follow-up call center offer to answer questions and close the deal. This multichannel approach not only increases visibility and engagement but also reinforces your message, ultimately leading to higher acquisition and retention rates.

Creating a card design that resonates

An effective card design is not just about visuals; it’s about creating a tangible representation of your brand’s value and the benefits offered to cardholders. In a competitive market, where customers are inundated with choices, the best credit card designs stand out both visually and physically, and can create a lasting impression, enhance brand loyalty, and drive engagement.

Consider when American Express converted their Platinum cards from plastic to metal — this change transformed the physical experience of the card, taking it to a whole new level. The weight and feel of the metal card made people stop and literally think, “This card is different.” This is a powerful example of how thoughtful design can do more than just look good — it can evoke emotion, convey prestige, and elevate the customer experience in ways that go beyond the aesthetic.

Here are some key considerations to help ensure your card design resonates with your customers.

Align design with brand identity and customer preferences

The design of your credit card should align with both your brand’s identity and the preferences of your target audience. For example, the successful revamp of the NFL Extra Points card program focused on incorporating team colors, logos, and fan-centric features that appealed to passionate sports fans. This approach not only strengthened brand affinity but also increased card usage and customer engagement.

Incorporate unique visual elements

Stand out by using unique design features such as vibrant colors, distinctive patterns, or custom illustrations that capture attention at first glance. The relaunch of the New York Yankees Mastercard® sought to utilize iconic branding elements, like the Yankees’ classic pinstripes and logo, to create a strong visual identity that appealed to the team’s dedicated fan base.

Collaborate closely with your card production vendor

It’s crucial to work closely with your card production vendor from the early stages of the design process. These experts can provide valuable insights on what will look best on the card material, ensure the durability of design elements, and help manage production costs. Vendors can advise on the most suitable materials, finishes, and printing techniques to ensure your design maintains its visual appeal over time while staying within budget.

Credit card activation strategies

Early engagement is critical in credit card marketing. The moment a customer is approved for your card is a pivotal opportunity to establish positive habits and encourage regular usage. By influencing behavior early on, you can create a “status quo bias” that makes your card the default choice for everyday spending.

Key strategies for driving activation include:

- Immediate onboarding and engagement

Welcome package and card-has-shipped messaging, emails, incentives for first-time use, and instant digital access to the card.

- Simplify activation

Make the activation process easy and offer multiple methods.

- Personalized offers and messaging

Tailor early communications and offers based on customer data.

- Reinforce benefits

Use continuous engagement tactics, like gamification and loyalty programs, to remind customers of your card’s unique advantages.

To dive deeper into these strategies and learn how to make your card the top choice from day one, read our full article on Credit Card Activation: How to Encourage Cardholders to Start Using Their Card Effectively.

Tracking the right metrics to measure success

To evaluate the effectiveness of your credit card marketing programs, it’s crucial to monitor key metrics that provide insights into both customer acquisition and retention. These metrics include:

- Customer acquisition costs (CAC)

Helps you measure how cost-effectively you’re gaining new customers.

- Customer lifetime value (CLV)

Indicates the long-term value a customer brings, helping you prioritize strategies that enhance retention.

- Activation rate and retention rate

Measure how many customers start using their card quickly and how many continue to use it over time, indicating engagement and loyalty.

- Net promoter score (NPS)

Gauges customer satisfaction and their likelihood to recommend your card to others.

- Marketing-related metrics

Monitor metrics such as response rates to marketing campaigns and Return on Marketing Investment (ROMI) to assess the effectiveness of your marketing efforts and optimize future strategies.

Tracking these essential metrics provides a comprehensive view of your program’s success, allowing you to identify strengths, optimize strategies, and drive better results.

For a deeper dive into all the critical metrics and how to effectively track and use them, explore our full article on Measuring Success in Credit Card Marketing: Essential Metrics to Track.

Your roadmap to credit card marketing success

From crafting a strategy that aligns with your brand’s goals, executing effective customer acquisition tactics, designing a card that customers love to carry, and ensuring they activate and use it effectively, we’ve provided you with the insights you need to stand out in a competitive market.

We also covered the critical metrics that help you measure the success of your efforts, enabling you to fine-tune your strategies for continuous improvement. Remember, the key to success in credit card marketing is not just in understanding these elements individually but in leveraging them together to create a cohesive, multichannel approach that meets your customers’ needs at every stage of their journey.

Throughout this guide, we’ve linked to a wealth of additional resources, from detailed articles on specific tactics to case studies demonstrating best practices. These resources are designed to equip you with actionable insights and tools to help you excel in your credit card marketing efforts.

You, too, can build a marketing program that not only attracts and retains customers but also drives long-term growth and profitability.

Prepping your launch?

Five steps to launching your credit card product

DOWNLOAD NOWOr build your next campaign with us.

We’ve been navigating these nuances since the ‘80s. If you need seasoned experts to help you determine next steps, we’re here to help.